Enough About Your Property Taxes

On red herrings, made up crises, and what you should actually care about.

Happy third week of October, to all those who celebrate arbitrary dates! I failed at my goal of writing a newsletter every week, since I was just too tired. Sorry about that.

The experiment a couple of weeks ago with providing you all some thought-provoking articles didn’t gain much traction (by which I mean that almost none of the folks who read this newsletter actually clicked on any of the links). I’m going to tell myself that’s because I so perfectly summarized each of the stories in a sentence or two, and so nobody felt the need to investigate further. That, or you don’t like reading, which is also a distinct possibility.

My motivation for writing this newsletter isn’t necessarily that everyone will want to read it, fortunately. If I wanted to pursue new readers as much as I want to just write the thing, I’d probably spend a lot more energy on promoting my posts. No, I write it to make myself spend more time writing. It’s serving that purpose nicely, so I plan to keep writing regardless of who’s reading.

This week, we’re going to take a look at property taxes. Not because property taxes are sexy (to most of us), but because in Ohio, property taxes are used to pay for a vast array of services at the local level that everybody needs and relies upon.

Ohio Representative David Thomas, one of Ashtabula County’s two Republican State Representatives, has been deputized by the Ohio GOP to be their point person on property taxes, for some reason. Despite not seeming to have much of a logical grasp on the issue, he has posted and tweeted hundreds of times about his commitment to “the taxpayers”. He says that he wants to fix the burdensomeness of Ohio’s property tax system, which would be great! Unfortunately, that “fix” has so far consisted of him insulting anyone who proposes actual solutions, trolling those who disagree with him, and suggesting that he knows more than pretty much anyone in Ohio state government about property taxes. He records video after video of himself talking about property taxes. He trolls those who try to engage him in a discussion about the issue. He mocks libraries and schools and county commissioners and anyone from either major political party who dares to suggest he is not the supreme authority on property taxes. He got several of his awful property tax “fixes” into Ohio’s budget this year, only to have most of them vetoed by Governor DeWine (which made him very, very unhappy). And he was the happiest boy at the birthday party the day that the Ohio legislature overrode one of those vetoes.

What was this groundbreaking bill that Rep. Thomas has championed for almost a year? Oh, it eliminated the ability of schools and libraries and other entities to ask for an emergency, substitute or replacement tax levy when they’re in an emergency fiscal situation. You know, the kind of situation that requires an EMERGENCY levy. In the midst of unprecedented financial instability, suicide and drug overdose crises, housing costs on the rise, and a million other issues, our state legislature spent countless hours of work in order to prevent Ohio’s voters from being asked whether they approve levies or not. They could care about Ohio’s citizens, almost 14% of whom live below the poverty line, or Ohio’s kids, 17.5% of whom live below the poverty line, and the challenges faced by them every single day. But instead, they care about property taxes.

Some people point to the fact that 69% of Ohioans own their own homes as a sign that doing something to decrease property tax burdens would help all of us. But sadly, that’s not the case. Who owns their own homes in Ohio? White people. Ohio has a massive gap between white and Black rates of homeownership. In fact, we’re the fifth worst state in the country in terms of that gap—meaning that around 73% of whites own their homes, and only around 37% of Black folks own their homes. A 30-37% gap in homeownership between races is not an accident—it’s due to historical and current inequities that our state legislature continues to ignore, such as mortgage discrimination and redlining. In fact, Cleveland has the largest such gap among cities with a population over 1 million in the entire United States. Since nearly 50% of Cleveland residents are Black, that difference among homeownership rates is even more starkly highlighted in Northeast Ohio (which is where Rep. Thomas is from, of course). Why does our legislature disregard race-related issues in Ohio? Because they’re spending all their time on stupid “property tax reform”, led by their leader, Rep. Thomas. They just don’t have the time.

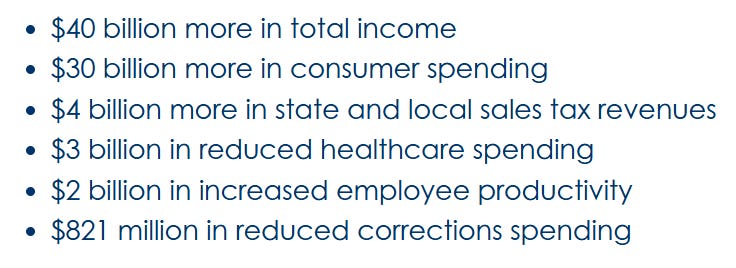

I’m advocating for Republican and Democratic lawmakers in Ohio to do something—anything—to address the impacts of racial disparities in this state. Why? Because it’s the right thing to do. For those who care less than me about doing the right thing, though, this great report by the Health Policy Institute of Ohio shows that racial disparities cost Ohioans a massive amount of money. They state that if these gaps were fixed in the state, we could gain an additional $79 billion per year in economic activity for Ohioans by 2050. Here are some other specific pots of savings that caring about race could generate:

So if you were an elected official who truly cared about saving Ohioans money, you’d be putting effort into fixing some of the issues that disproportionately harm people of color in this state. Just saying.

Anyway, after Governor DeWine vetoed the provisions related to property taxes in the budget (because of the funding apocalypse they would cause), he ultimately bent to the will of the legislature and created a commission of property tax experts to evaluate some reforms that might actually make a difference. The commission met and came up with twenty suggestions. Some of them make a lot of sense! Here’s the full report from the commission, released within the past few weeks. And how did Rep. David Thomas react to those suggestions? Here’s a local headline:

He’s “not impressed”, we learn in that article, because he doesn’t think the members appointed to the commission by Governor DeWine (who has been a leader in the Ohio Republican Party since before Rep. Thomas was born), don’t know what they’re talking about. He says they’re biased, he says they’re not proposing draconian enough cuts, and he says he knows how to handle it better than anyone else, more or less. He claims that the commission’s experts were biased because some members of the group are biased due to representing school districts (even though only two of the eleven commission members were school superintendents).

Have you heard about the other big initiative in Ohio related to property taxes (other than the imaginary “solutions” bouncing around our legislators’ heads)? The “Committee to Abolish Property Taxes” is a group of (largely) wealthy Ohioans who are determined to get enough signatures for a ballot initiative that would eliminate all property taxes in the state of Ohio. They’ve been gathering signatures since the end of spring, and usually “decline to answer” when asked by media representatives about how many of the required signatures they’ve gotten. Luckily, we can get an actual number from this Signal article, where we read:

Brian Massie said his group’s goal is to collect 600,000 voter signatures before the June 2026 deadline, which requires 413,487 signatures – including a minimum number from 44 of Ohio’s 88 counties – to get the issue on next November’s ballot.

Massie said he’s the only person who knows how many signatures the committee has collected and has been keeping that number a secret to remind state politicians whom they work for, he said.

But with some prodding, he offered a ballpark figure: It’s fewer than 200,000.

Is it possible that these zealots are exaggerating just how many people actually support this ridiculous proposal? I think that’s likely.

The title of this Newsweek article about the “solution” of getting rid of our property tax says it all, I think.

Ouch. We cannot go down this road, and it is a ridiculous argument to say that we must drastically change our property tax structure (and do it immediately) due to this being the biggest challenge we currently face.

Chances are, you’ve seen some of these folks in comment threads on Twitter or Facebook over the past few months. Anytime anyone mentions property taxes, about five of the same people pop up and say something about how “all property taxes are theft”, or about how “we must eliminate all property taxes, nothing else is acceptable”, or about how “old people are being forced into homelessness right and left due to property taxes”. They say that any funding shortfalls created by getting rid of property taxes would “need to be dealt with by the legislature”, but offer zero ideas of how to do that. They also say that sales taxes need to be increased to make up the difference, since we can decide what we buy but cannot decide whether or not to pay property taxes. I even saw one of these folks today claiming that the plan needs to be to get rid of all property taxes on people, but THEN create new laws to create property taxes for corporations and landlords. Which would be an incredibly unlikely series of events, but okay.

What negative ramifications would we see if we allowed those who currently represent us in public office to keep chipping away at our property tax structure? Let’s look at just a few.

Here’s one description of what could happen, from a recent Cleveland.com article:

Imagine if almost overnight, two thirds of the money coming into your household evaporated and you had to find a way to pay your bills with what remains.

That’s a strong possibility that Northeast Ohio libraries and the Cleveland Metroparks are grappling with as the day comes ever-nearer when voters could abolish all property taxes in the state.

Or this, from Greg Lawson at the conservative Buckeye Institute, as quoted in the Ohio Capital Journal:

“Even if you cut back on some of the local spending to make it more efficient, which is, in long run, a good thing to do,” Lawson said, “it would still mean you’re going to have exorbitantly high sales or income taxes. Either that or you don’t get the service — it’s really that simple.”

And Ohioans NEED those services. Our libraries and public schools and first responders and local municipalities NEED that property tax revenue. The state has long chipped away at state funding for those essential services, leaving them to rely on property taxes instead. The state should restore that funding at appropriate levels if they really care about tax burdens on homeowners. Even though the Ohio Supreme Court has ruled that the state’s private school voucher program is unconstitutional, the Ohio GOP has ignored that ruling and continued business as usual (just like they ignored five Ohio Supreme Court rulings that they must re-draw our unconstitutionally-rigged congressional districts).

So let’s take a look at a few of the arguments currently being made in favor of us abolishing property taxes in Ohio.

How many people lose their homes in Ohio each year as a result of not paying their property taxes? The truth is, we just don’t know. While I’ve seen the figure of 5,000 homes lost by homeowners due to property tax foreclosures each year, it appears that there’s no good source for that (other than multiple articles saying that an economist estimated it’s roughly 5,000 homes per year over the past decade). This article states that Ohio is fourth in the country in terms of foreclosures, based on the fact that we currently had 1,842 properties being foreclosed upon when it was written. That said, there’s a long way to go from 1,842 to 5,000. But if we take that 5,000 homes figure as fact (even though I’m suspicious of its accuracy), what percentage of Ohioans does that amount to who would be losing their homes due to this reason? Well, OhioRealtors.org says that Ohio has 3.4 million owner-occupied homes at the moment. Those 5,000 homes are a big deal for those 5,000 families, but would amount to around a tenth of one percent of owner-occupied homes in the state. Not a big number at all, it turns out. And beyond that, there’s no good data I can find that shows us what percentage of those foreclosures is due to nonpayment of mortgages or any number of other reasons beyond property tax burden. We just don’t know, but we do know that numbers are likely far lower than is being claimed. And this article from CBS News tell us that foreclosures in the United States as a whole actually “remain well below their pre-pandemic levels”. Is it possible, perhaps, that this is less of a widespread problem than some folks want you to think?

How about the argument that senior citizens are more likely to lose their homes due to property taxes? Once again, we have no good data to substantiate that claim. It’s true that seniors may be on fixed incomes, and it’s also true that property taxes are higher in Ohio than all but seven other states in the country. But something which is lost in this debate is the fact that those higher home values means that there’s also a concentration of wealth in the form of home equity (especially for older white folks who likely bought their homes when they were valued much lower). I might go so far as to say that those who have hugely valuable assets such as homes are more privileged and in a far better position as far as their quality of life than those who are living in poverty, have zero assets, and are subject to being gauged by unscrupulous landlords who can feel free to charge anything they want for rent. If you cannot afford to pay your property taxes, you can sell your home and buy a cheaper house with the proceeds from your expensive home (which would leave a lot of money to spare). If you cannot afford to pay your rent, you will become homeless. It’s clear to me that the second category of people have a much harder time getting by.

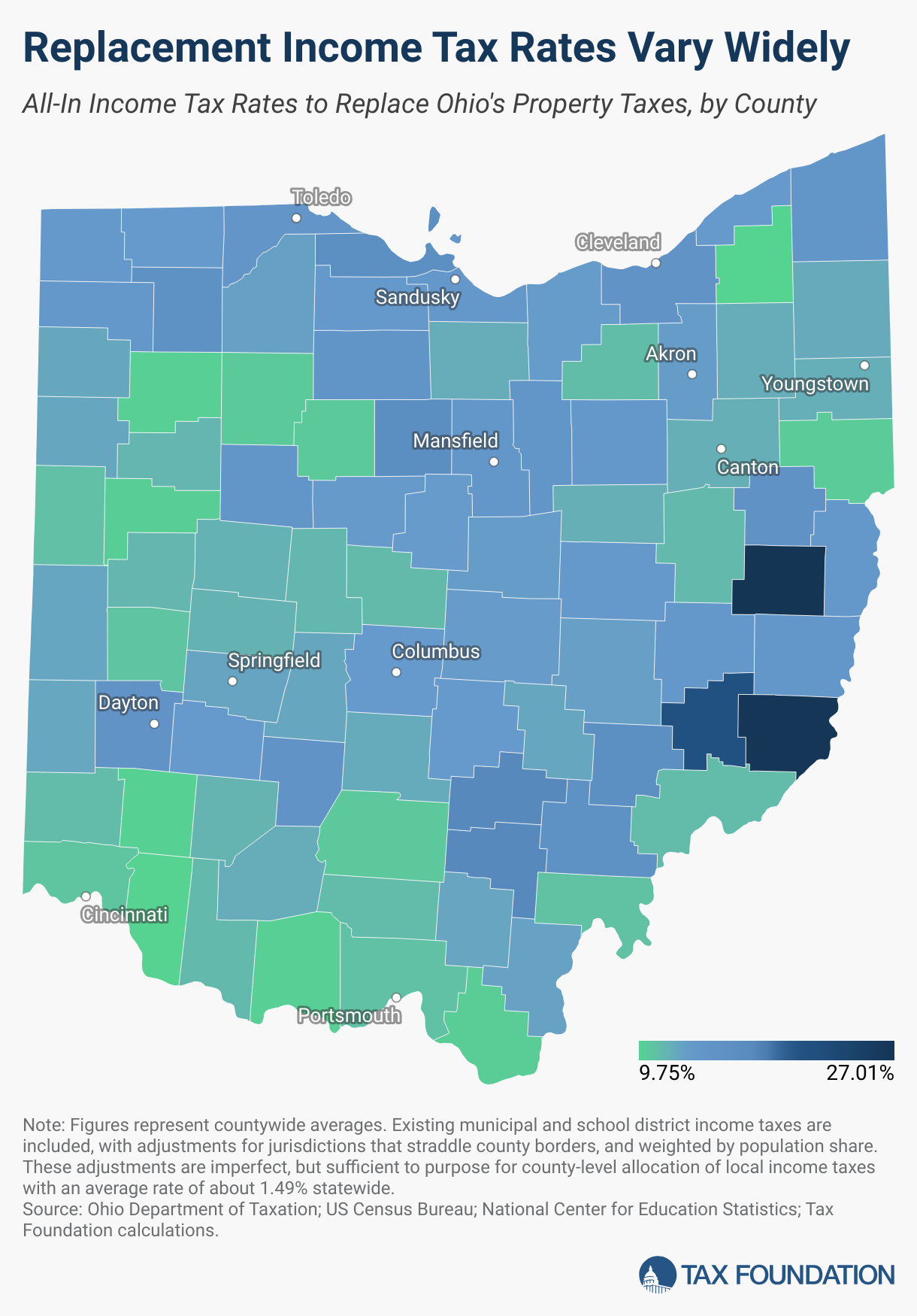

How about the claim that income taxes could be raised to high enough levels to replace the $24 billion that Ohio brings in each year from property taxes. Signal published an excellent article earlier today that looked at this exact argument. Take a look at this graphic from their piece, which was generated by the nonpartisan Tax Foundation:

This shows just how high your income taxes would need to go in order to backfill the revenue that property taxes currently bring into your local community. If you read my earlier piece on Ohio’s income tax structure, you’d know that the highest income tax rate in the state is currently 3.75%. The Tax Foundation analysis shows that income tax in Ashtabula County would need to go up to 14.3% to make up a complete loss of property tax revenue. In some counties, such as Harrison, their income tax would need to go to 27%! Monroe County would go to 26.75%, and Noble would have to go to 21.17%. That would be an absolute disaster for people living in those counties. Can you imagine what it would do to your household budget to see your income tax rate increase by more than 23%? Talk about increasing rates of homelessness…that would be unsustainable for anybody, no matter what, not just homeowners. All those people who cannot currently afford to buy a home would be paying those increased income tax rates, so the pain would be distributed much, much further than it is now.

And what about the suggestion that’s floating around to replace property taxes with sales tax increases? This excellent article written by Nancy Nix, the Auditor of Butler County, lays out the case for how disastrous that would be. As she writes,

For example, the total amount of sales tax that would be needed in Butler County to offset the loss of $660 million in property taxes billed for the 2024 tax year would be 14.83% (a sales tax increase of 128%). That assumes spending habits don’t change, and they undoubtedly would. And sales tax is regressive in that it takes a larger percentage of income from lower-income individuals than from higher-income individuals.

Can you imagine making the argument that increasing Ohioans’ sales tax by 128% is a positive thing? Honestly?

Nix continues,

With only Local Government Fund money provided by the State to offset the loss of property taxes, Ohio townships would be hard pressed to continue to operate fire/EMS services, road and bridge improvements, police protection and pay their debts should the property tax be eliminated. The State Legislature would need to increase funding and/or allow townships to place income tax levies on the ballot or pass them directly through a vote of their Board of Trustees.

Per the Ohio Township Association (OTA), townships serve approximately 35% of the state’s population. According to OTA Director of Governmental Affairs, Kyle Brooks, “Eliminating property taxes without a responsible, well-defined alternative would leave townships with no path forward. It would gut local services, jeopardize public safety, and create an unsustainable future for Ohio’s 1,308 townships.”

So we gut the funding that’s providing roughly 65% of the revenue that local governments need to function, and just assume that everything will be completely fine. Got it. Makes perfect sense to me.

Why are Rep. Thomas and his fellow Republicans pushing for so many “reforms” to property taxes that actually exacerbate Ohio’s fiscal issues? They claim that the ballot initiative has such a head of steam and is so popular that if they don’t do something to make changes, the alternative will be Ohioans voting to abolish property taxes entirely (so they’re doing us a favor by finding a middle ground). But this Signal article shows that the ballot initiative isn’t getting the kind of major funding and visibility that was originally claimed, and that it’s proven to be far less popular than they made it seem at the outset. This push by Ohio’s Republicans clearly appears to be a “solution” in search of a problem which does not actually exist in sufficient numbers to make it this big a priority.

In the midst of all this discussion about the poor taxpayer who cannot afford to stay in their homes, we see Republican giveaways like this one, again cited by Signal:

Among the long list of parties who say their taxes are too high: clients of Horsepower Farms, which calls itself a “storage condominium” for expensive collector cars. The Powell, Ohio, facility’s website includes pictures of fancy sports cars and retro domestic roadsters in a 52-unit facility, which is a community hub for car aficionados.

The owners don’t generate income from the condos. So it’s unfair, they say, that their ownership of the car condos is taxed as commercial property.

Rep. Brian Lorenz, a Republican who represents Powell, a wealthy enclave north of Columbus, has introduced legislation to classify the condos as personal, not commercial, property. That came up for its fourth hearing Wednesday, but it received no vote.

Horsepower Farms and several of its clients testified in support of the bill. In this case, the luxury car owners say their Porsche “condos” are classified by the tax code in an unfair way.

But every tax break for one party shifts the tax burden somewhere else. Reclassifying the car condos would cost Delaware County between $36,000 and $45,000 per year, depending on whether businesses that own the units transfer ownership to individuals, who could claim the better rate.

The bill offers a curious case of how lawmakers, with this much scrutiny on homeowners’ rising tax bills, are willing to approach an arguably unfair taxation rule if the end result is shifting more tax burden onto homeowners.

Does the hypocrisy never end? Let’s not even mention the multi-billion dollar giveaway from state Republicans that has enabled the billionaire Haslam family to build a new Browns stadium outside the city of Cleveland, or the billion dollars the Republicans have taken from public schools to give to wealthy families in the form of private school vouchers. U.S. News and World Report says Ohio is ranked 41st out of all 50 states in terms of its natural environment. It’s ranked 39th in terms of its economy. Our infant mortality rate is 44th in the nation. And even worse, although our infant mortality rate for white kids is 7 out of every thousand (far higher than the national rate of 5), Ohio’s infant mortality rate for Black infants is DOUBLE that, at thirteen deaths per thousand children. As this WOSU article points out, we have a massive issue with infant mortality, especially in communities of color within Ohio. But are we doing anything about that? Nope, we’re too busy arguing about property taxes for a few people. (Or car condos, perhaps?)

I could easily go on—suicide is the second leading cause of death in Ohio among multiple age groups, but do you hear your state Senator or Representative discussing doing everything we can to reduce suicides? I have spent the past ten years specializing in clinical work with those who have lost a friend or family member to suicide. I have lost clients and co-workers and other people I care about to suicide. Have you heard people in positions of power speaking half as passionately about suicide as they do about reducing property taxes? You have not.

The opioid epidemic began in Ohio, and our overdose rates have been higher than those in the country for most of a decade now. Do you hear your elected officials prioritizing a single evidence-based strategy for saving more folks from overdoses (other than pretending that the horrific strategy of arresting grandmothers and veterans and children is going to somehow protect us all from fentanyl)? I have lost people I deeply care about (and almost lost many others) to fentanyl overdoses, and that has affected how I think about substance use. Have you heard your local elected Republicans speaking with compassion about this issue? President Trump and his administration are literally taking away funding, tools, and entire agencies dedicated to substance use disorder treatment. They are responsible for killing your friends and family by supporting these actions, and yet they rant and rave about property taxes.

Our national rankings have fallen across the board, all while our state has had more and more Republican representation (largely due to unfair drawing of congressional maps, which, as I’ve previously discussed, ignores the fact that 45% of Ohioans tend to vote on the liberal side of center). The Ohio GOP has failed us, and they need to be held accountable at the ballot box. We need to care about all of the issues I’m discussing in this newsletter, and anyone who claims property taxes should be our number one priority is seriously, grievously, tragically mistaken.

Here’s the truth:

Property taxes are too high in Ohio.

We cannot continue to alter our property tax structure without first examining how to make up the funding shortfalls to local governments, including fair funding of libraries, schools, fire/EMS services, road and bridge repair, etc.

We have literally hundreds of issues in this state that should be higher priorities than property taxes.

Elected officials who continue to ignore those far more important problems in favor of this one issue need to receive electoral consequences for their systemic neglect of the problems that actually harm their constituents.

Easy, right? I sure wish we could all focus on those four points, instead of endlessly arguing with the Facebook trolls who imagine that nobody ever suffered more pain than they did as a result of paying taxes on their expensive homes (or condos for their luxury cars, take your pick).

I moved to Ohio 29 years ago, and have only very rarely regretted that choice. I’ve been an Ohioan for 60% of my life at this point, and love it here. When you love something, you need to be honest about it, hence my harsh words. If people in positions of power loved the state as much as I do—as much as you probably do—they would be making different decisions.

Please ponder the ramifications of this, and the next time someone tells you that property taxes need to go away ASAP, direct them my way (or just tell them how misguided they are yourself, even better). I may not have enough time in my day to argue about property taxes 24/7, but I’m sure willing to try. Join me!

I hope you learned something in this week’s installment, and I promise to keep writing (whether anybody’s reading or not). Take care (and don’t let them defund your libraries and schools)!