Ohio's New Flat Tax: What Does It Mean?

Who benefits, who doesn't, and why?

Hi there, and welcome to the first edition of What We Can (Learn)!

How much do you know about the new changes to Ohio’s income tax structure? Do you think a flat tax is a positive thing or a problem for our state? Did you have any idea, before just now, that Ohio just made massive changes to our income tax model?

No worries, let’s learn some key concepts together:

State income tax is the share of each Ohioan’s earned income that we pay to the state government for the privilege of living and working here.

Most states (26, to be exact) have a progressive income tax system. A few states (16, including Ohio in the near future) have a flat income tax system. Eight states don’t have any income tax at all.

“Progressive income tax system” means that people who make more money pay a bigger percentage of their income in income taxes.

Income tax revenue represents 36% of Ohio’s general revenue, give or take.

This state established an income tax in 1972, before I was born. By the early 1980s, we had eight different earnings brackets (based on how much you made) that dictated what percentage of your income would be owed to Ohio. The Ohio Republican Party has put a great deal of time, energy, and money into eliminating those earnings brackets, one by one.

The case the GOP makes is that people who make more money shouldn’t pay a bigger percentage in taxes, because it’s good for us all when rich people are happy (more or less). They believe that being wealthier doesn’t carry any increased responsibility to give back to your community or your state. I disagree—I feel that a huge part of our wealth is a result of where we live and the opportunities we’ve been given. It’s about being grateful for the circumstances that have set us up for that wealth in the first place, and is the right thing to do. Trickle-down economics (the idea that rich people will help poor people with their scraps if we just encourage them to get richer) has been disproven by every measure of economics. It just doesn’t work that way, because it ignores the basic human fact of greed: most of us like to get richer, and fewer of us want to lift everyone out of poverty. It just doesn’t work, period. A key reason we need to have safeguards in place to help protect everyone is because rich people tend to want to stay rich. As the Roosevelt Institute writes,

The trickle-down economics theory embraced by the Reagan administration and many of its successors claimed the benefits of these tax cuts would spur growth and create a rising tide that would lift all boats. In the immortal words of Chilli Heeler, “Neither of those things are happening.”

Which brings us to this week. Our governor, Mike DeWine, just signed the next Ohio state budget into law today. It included a provision that drastically changes how income tax works in this state (starting next year, and then ending with a flat tax in 2026).

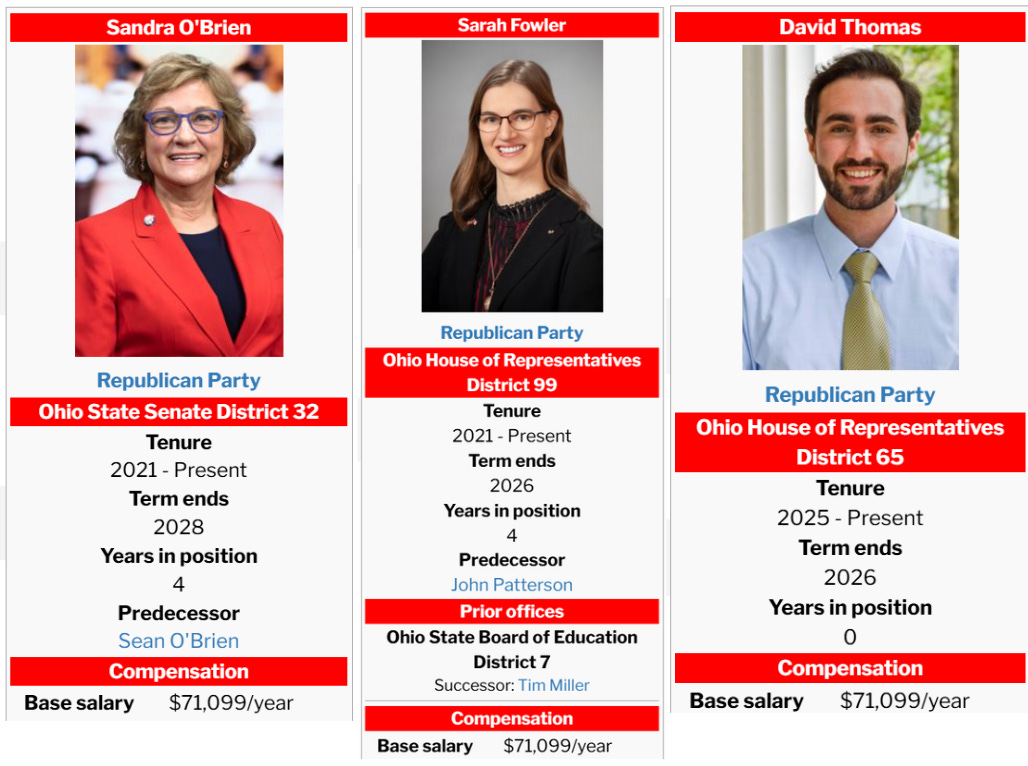

Here are my/your current statewide elected officials (for Ashtabula County folks):

It’s always great to know the folks who represent you, right? Sandra O’Brien is our State Senator, and Sarah Fowler Arthur and David Thomas are our State Representatives.

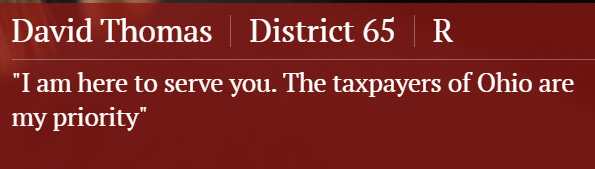

Got it? These are the three elected officials whose responsibility is to look out for people in our community. In fact, here’s the main quote Rep. Thomas highlights on his Ohio House webpage:

Isn’t that amazing? We’re his priority, which feels really nice. That’s the way it should be. I appreciate that a great deal, as should we all.

If you don’t live in Ashtabula County but are in Ohio, go here to find out who represents you in the Ohio House of Representatives (scroll down and enter your address).

Here’s the link to find out who represents you in the State Senate.

If you don’t live in Ohio at all, please do your own research to find out 1. Who represents you on a statewide level, 2. How your state calculates income tax, and 3. How your elected officials voted on your most recent changes to income tax law. Play along at home!

Now, let’s look at what this flat tax will do to the state budget. Remember how I said that in the early 80s, higher-paid workers in Ohio owed a much higher income tax percentage? Back then, as Signal Ohio says, “top earners paid $5,890 plus about 9.2% of all earnings over $100,000”. Do you know what the top income tax rate in Ohio was last year? 3.5%. That’s five and a half percent lower than it was when I was a child, which is a huge drop. And do you know what it’ll drop to in 2026? Just 2.75%. There’s a smaller drop next year and then, after that, every taxpayer in the state will hit that 2.75% rate (or zero, for those who make too little to be taxed on their income at all).

What does this all mean? Let’s head back to Signal Ohio for a breakdown of why this is a big deal on the individual taxpayer level.

They write,

“Imagine three Ohio workers who earn what the Bureau of Labor Statistics estimates as the average salary for their professions: an orthopedic surgeon making $455,000 per year; an engineer making $120,000 per year; a construction worker making $61,000 per year; and a server making $30,000.

Using 1972’s tax rates, the surgeon would pay $15,425 in taxes; the engineer would pay $3,700; the construction worker would pay $1,635; and the server would pay $600. When Ohio taxed income at its highest rates of 1984, everyone’s tax bill went up, but the bigger burdens fell on the bigger breadwinners. The surgeon paid about $38,200; the engineer paid about $7,500; the construction worker paid about $3,000; and the server paid about $1,100.

Fast forward to next year when the new rates would take effect. The surgeon would owe about $12,100 in taxes; the engineer would owe about $2,900; the construction worker would owe $1,290; the server owes $440. Compared to today’s rates, the surgeon and the engineer get a tax cut, while things stay the same for the construction worker and the server.

Over a longer period of time, everyone’s tax bill decreased, but most of those savings went to the doctors and engineers of the world over the servers and construction workers.”

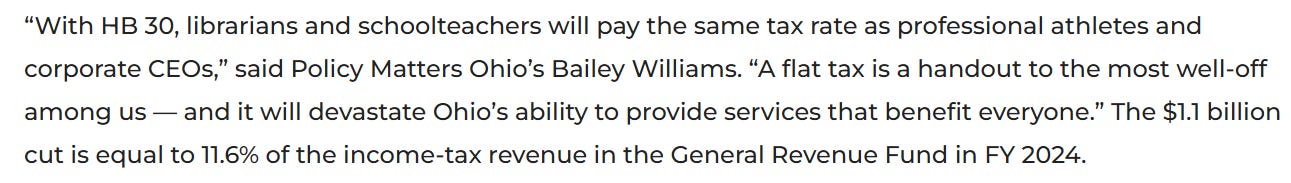

Do you see why this is an issue? Those among us who have the least money see zero change in their actual financial picture, those among us who have the most money get some benefit, and the state loses a LOT of money. How much money, exactly?

Oof. A billion dollars in lost revenue, and none of it goes to folks living in poverty? That doesn’t sound like something that has the best interests of all Ohioans—or all voters—or all taxpayers, for that matter—at heart.

Okay, so we lose almost 12% of state income-tax revenue. But how are the Republicans framing this change? Let’s see:

That’s from Rep. Thomas’s press release celebrating this provision of the budget. It sounds like he’s saying it makes us “more competitive” with surrounding states. Does that sound to you like it’s intended to put us on par with our neighboring states? Let’s look at the math. Signal Ohio says:

Ohio’s top rate proposed in the budget would be lower than all nearby states. Michigan’s is 4.25%; Indiana’s is 3%; Kentucky’s is 4%; West Virginia’s is 4.8%; and Pennsylvania’s is about 3%.

Wait, I thought we needed to get competitive with nearby states? It looks like we were already lower than everyone in the neighborhood but Pennsylvania and Indiana. Sounds like we were already pretty competitive! To the “spurs revenue” point, there’s no serious economic proof that giving wealthy people more of a tax cut does anything but spur their individual bank accounts, sadly. Otherwise, business would be booming in Ohio, and that’s just not the case.

How did our elected officials represent Ashtabula County residents in this instance? Sarah Fowler Arthur was one of only twelve State Representatives to sponsor HB30 (the House version of the income tax reduction bill). Sandra O’Brien was one of only seven Senate co-sponsors of SB3 (the Senate version of the income tax reduction bill). And we’ve already seen how much Rep. Thomas has championed this change.

The vast majority of the benefit from this income tax change (96% of the money) will go to those making over $138,000 per year. If you were wondering, that’s a bit less than 13% of Ashtabula County households. A very small number of people in this community will benefit, in any real way, from this policy. Don’t let them get away with trying to make the argument that they have your best interests at heart (you’re smarter than that)!

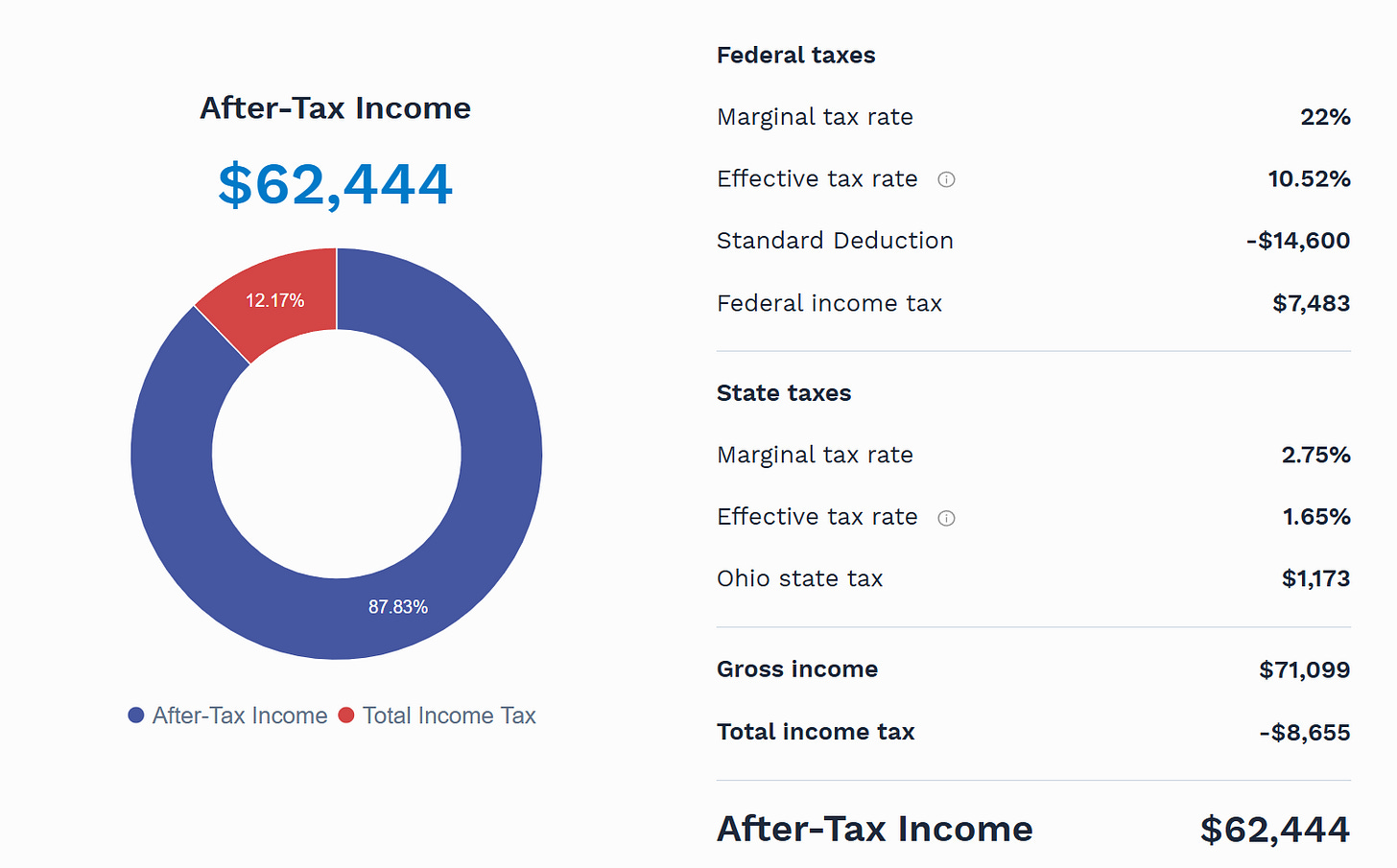

Let’s see what this means for our elected officials themselves. It’s more complicated for Rep. Fowler Arthur and Sen. O’Brien, but since Rep. Thomas isn’t married, if he had no additional income beyond his publicly-available Ohio salary and took the standard deduction, here’s what Forbes says he owed in taxes under the current (prior) tax plan.

Whoa! Rep. Thomas’s tax picture looks like he’s being taxed at a rate of 2.75, in that prior middle bracket that no longer exists—but under the new plan his tax will sit at 2.75% anyway, like everyone else’s. If you make a billion dollars of income in Ohio in another year or so, you’ll be taxed at a rate of 2.75% just like whoever our State Representatives are at that point (fingers crossed for some changes there). Do you see the issue here? We are literally leaving a billion dollars on the table with this move, and it doesn’t even personally benefit Rep. Thomas. Just his rich buddies (or the rich folks he wishes were his buddies).

So let’s recap:

This change will not benefit those earning less than $26,050 in the slightest (they’ll still pay no income taxes).

This change will loot a billion dollars from the state per year, or almost 12% of the total income tax paid to Ohio.

Almost 20% of Ashtabula County residents are living below the poverty line and won’t receive a penny from this bill.

About 13% of Ashtabula County households earn between $125,000 and $200,000 per year, and will see their taxable income percentage drop from 3.5% down to 2.75% over the next couple of years.

All three of your statewide elected officials are huge fans of this massive alteration to the way Ohio calculates income tax, even though it only helps the very wealthy.

Here’s what I’m asking of you, having learned all about the big changes to income tax that were just signed into law by Governor DeWine yesterday:

Think about the info in this newsletter—do you agree with me that this was a massive mistake that only benefits the very wealthy? If so, see point 2.

Talk to other people in your life about why you think we shouldn’t support giveaways to the richest tiny fraction of those in our community while maintaining the status quo for an equivalent number of folks here who live in extreme poverty.

The next time you go to the Dollar Store on your corner (or the other Dollar Store a block away, or the Dollar General across the street from those two stores), consider how many items you could buy with that $1.1 billion.

When you see Rep. Fowler Arthur, Rep. Thomas, or Sen. O’Brien at a local event, politely ask them why they think the richest among us deserve to pay the same income tax rate as you do, and why we should take a billion dollars out of the state General Revenue Fund that only helps a few Ohioans.

Next year (in November of 2026), strongly consider voting for two different State Representatives who might just care about everyone in Ashtabula County, not just a few of us.

Senator O’Brien’s election isn’t until 2028, but you know what to do there as well.

And there you have it—the first installment of What We Can (Learn). I hope you found this piece both informative and useful, and I hope it makes a difference to your ability to advocate for future policy changes that benefit everyone. Share with anyone you think might appreciate the information, and as always, I appreciate you reading this!

Sources:

https://signalohio.org/ohio-budget-cuts-income-taxes-to-historic-lows-almost-all-savings-go-those-making-more-than-138000/

https://policymattersohio.org/news/2025/06/16/eliminating-ohios-property-taxes-goes-too-far/

https://taxfoundation.org/location/ohio/

https://www.wfmj.com/story/52891417/new-ohio-budget-sets-course-for-275-flat-income-tax-by-2026

https://policymattersohio.org/news/2024/01/30/new-data-show-just-how-upside-down-ohios-tax-code-is/

https://datausa.io/profile/geo/ashtabula-county-oh

https://itep.org/state-rundown-6-25-the-numbers-dont-lie-state-budget-edition/

https://policymattersohio.org/news/2025/03/26/flat-income-tax-would-gut-ohios-budget/

https://ohiohouse.gov/news/republican/ohio-house-passes-budget-plan-that-delivers-historic-property-tax-relief-for-ohioans-implements-nations-second-lowest-income-tax-rate-135035

https://www.billtrack50.com/billdetail/1817172

https://www.ohiohouse.gov/members/david-thomas/news/rep-thomas-votes-on-budget-plan-that-delivers-historic-property-tax-relief-for-ohioans-implements-flat-tax-135042

https://www.ohiosenate.gov/members/sandra-obrien/legislation

https://rooseveltinstitute.org/blog/the-trickle-down-tax-code-failed/

https://www.forbes.com/advisor/income-tax-calculator/ohio/